are hoa fees tax deductible in florida

If the timeshare is a rental property however hoa fees do become deductible. State and local tax deductions are capped at a combined total.

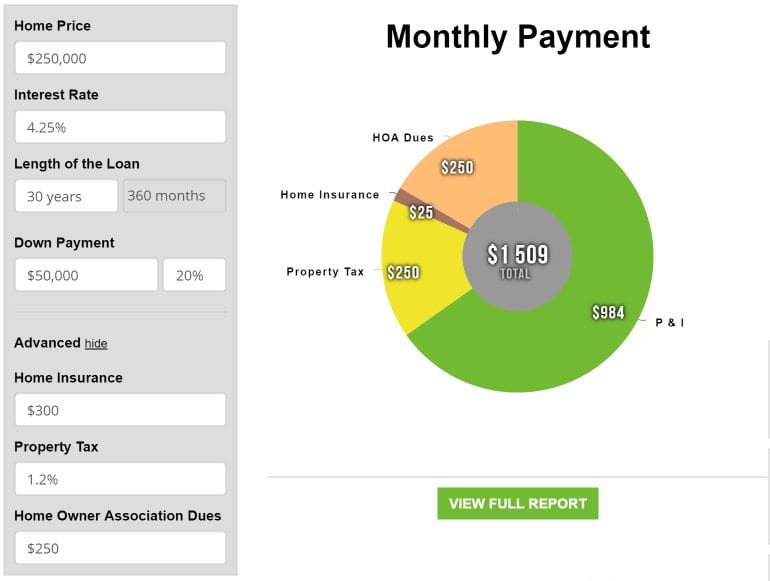

Hoa Dues Can Make A Condo More Spendy Than A House Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Law Of Florida Homeowners Association By Peter M Dunbar Charles F Dudley Paperback Barnes Noble Primarily HOA fees are not tax-deductible when you as the homeowner reside in.

. What Is The Mailing Address For Irs Tax Returns. In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. In other words hoa fees are deductible as a rental expense.

As a general rule no fees are not tax-deductible. Payments for cdd fees are tax deductible consult your tax professional for details. In general homeowners association HOA fees arent deductible on your federal tax return.

This guideline also applies if you merely have a small home office. For example if you utilize 10 of your home as an office 10 of your HOA fees are deductible. Keep your property tax bills and proof of payment.

The answer regarding whether or not your hoa fees are tax. How to Deduct HOA Fees on. Filing your taxes can be financially stressful.

Though many costs of owning a timeshare are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because. Are Hoa Fees Tax Deductible In Florida. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas.

As a homeowner it is part of your. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Do You Pay Transfer Tax On Refinance In Florida.

The IRS views them as personal expenses not a tax rendering them ineligible as tax deductible. However there are some exceptions to this rule. For example if youre self.

But there are exceptions. In general HOA fees are not tax deductible in California. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities.

When it comes to whether or not these membership fees can be deducted from your income there are three answers. Primarily HOA fees are not tax-deductible when you as the homeowner reside in it 100 of the time. If the HOA fees are associated with your.

Yes you can deduct your property taxes off your tax return. It does this with the help. There may be exceptions however if you rent the home or have a home office.

How To File Taxes Doordash. You can claim the HOA fees as a tax deduction because the costs are an expense you have to incur to maintain the property even though you arent the owner. Homeowners association fees hoa fees.

The IRS considers HOA fees as a rental expense which means you can write them off from your. However there are special cases as you now know. You cannot claim a deduction for the HOA fee when it is your primary residence.

Are HOA Fees Tax Deductible. You can also deduct 10 of your. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood.

You also do not need to have the whole house rented out it can just be a part of the house for example a room a. You may be wondering whether. So yes HOA fees can be deductible if your house is a rental property.

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Cedar Management Group

Florida Homeowner Associations And Federal Income Tax Considerations Jimerson Birr

Are Hoa Fees Tax Deductible The Handy Tax Guy

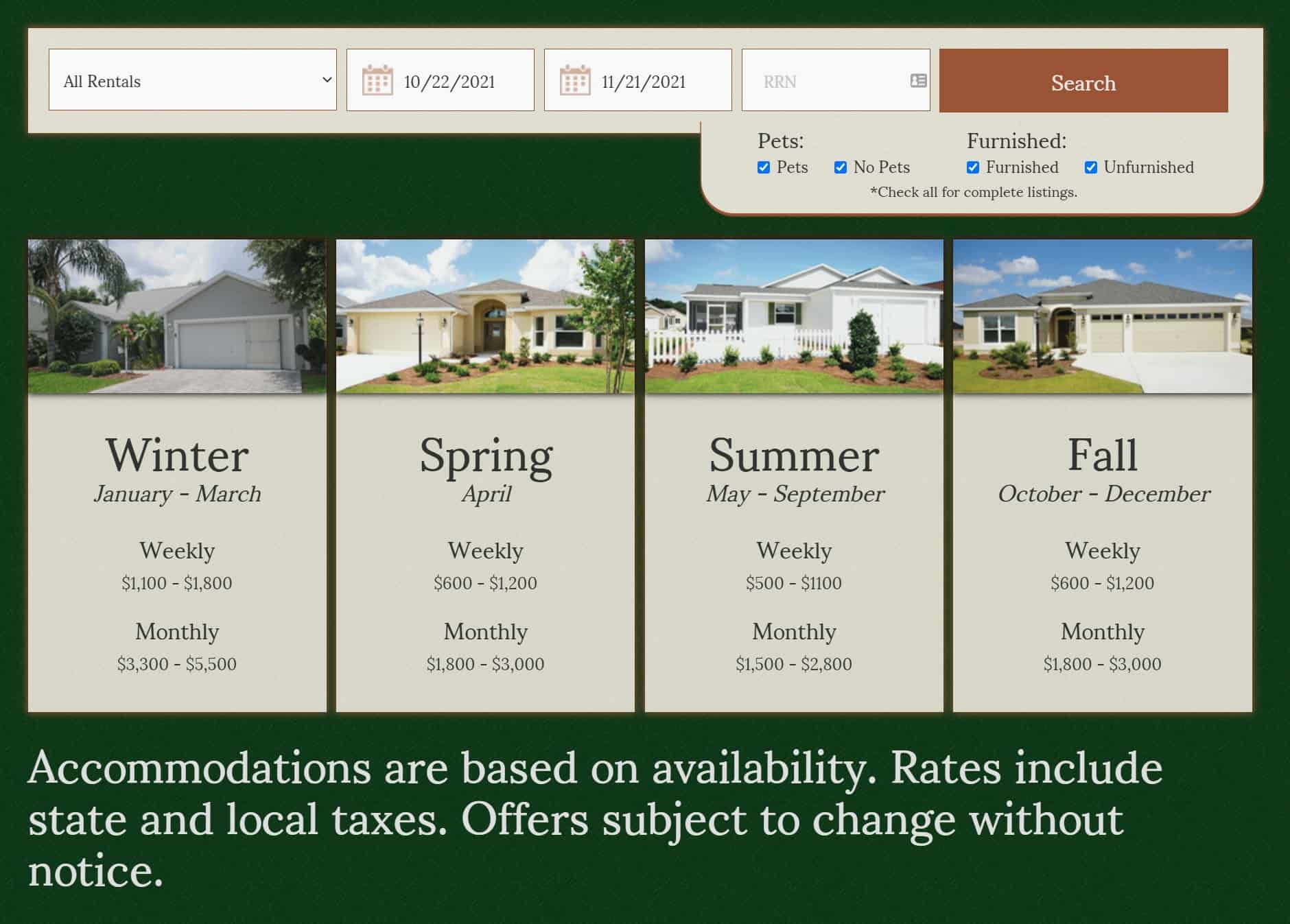

The Villages Fl Cost Of Living How Much Does It Cost To Live In The Villages In Florida Data Tips

Hoa Fees Everything You Need To Know Bankrate

Home Buying 101 Tax Benefits For Florida Homeowners

Hoa Dues Great Park Neighborhoods Community Association

Is Hoa Tax Deductible When Homeowners Can Deduct Hoa Fees

Florida Cdd Fees What You Need To Know

Can I Write Off Hoa Fees On My Taxes

Can I Write Off Hoa Fees On My Taxes

Should I Move To Florida To Save On Taxes Moving To Florida

Can I Write Off Hoa Fees On My Taxes

Are Hoa Fees Tax Deductible The Handy Tax Guy